ESG2Risk: A Deep Learning Framework from ESG News to Stock Volatility Prediction

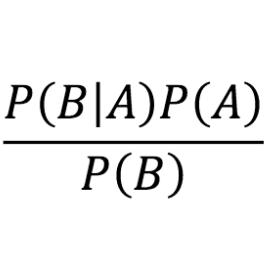

Incorporating environmental, social, and governance (ESG) considerations into systematic investments has drawn numerous attention recently. In this paper, we focus on the ESG events in financial news flow and exploring the predictive power of ESG related financial news on stock volatility. In particular, we develop a pipeline of ESG news extraction, news representations, and Bayesian inference of deep learning models. Experimental evaluation on real data and different markets demonstrates the superior predicting performance as well as the relation of high volatility prediction to stocks with potential high risk and low return. It also shows the prospect of the proposed pipeline as a flexible predicting framework for various textual data and target variables.

PDF Abstract