Hidden Markov Models Applied To Intraday Momentum Trading With Side Information

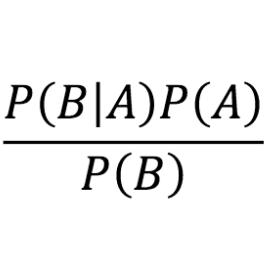

A Hidden Markov Model for intraday momentum trading is presented which specifies a latent momentum state responsible for generating the observed securities' noisy returns. Existing momentum trading models suffer from time-lagging caused by the delayed frequency response of digital filters. Time-lagging results in a momentum signal of the wrong sign, when the market changes trend direction. A key feature of this state space formulation, is no such lagging occurs, allowing for accurate shifts in signal sign at market change points. The number of latent states in the model is estimated using three techniques, cross validation, penalized likelihood criteria and simulation-based model selection for the marginal likelihood. All three techniques suggest either 2 or 3 hidden states. Model parameters are then found using Baum-Welch and Markov Chain Monte Carlo, whilst assuming a single (discretized) univariate Gaussian distribution for the emission matrix. Often a momentum trader will want to condition their trading signals on additional information. To reflect this, learning is also carried out in the presence of side information. Two sets of side information are considered, namely a ratio of realized volatilities and intraday seasonality. It is shown that splines can be used to capture statistically significant relationships from this information, allowing returns to be predicted. An Input Output Hidden Markov Model is used to incorporate these univariate predictive signals into the transition matrix, presenting a possible solution for dealing with the signal combination problem. Bayesian inference is then carried out to predict the securities $t+1$ return using the forward algorithm. Simple modifications to the current framework allow for a fully non-parametric model with asynchronous prediction.

PDF Abstract